This frequent determination has permitted him to show his passion right into a job and sooner or later led him to work While using the justETF crew. He shares with us the mission of creating ETFs more comprehensible and accessible to most of the people.

Conversely, an AP also buys shares on the ETF to the open industry. The AP then sells these shares back again on the ETF sponsor in exchange for individual inventory shares which the AP can promote around the open up sector.

Taking it too much, however, could lead on to portfolio bloat and overdiversification. It happens when the extra benefit of reducing risk via diversification starts for being outweighed with the marginal loss of the predicted return. Keeping more stocks basically to the sake of having more holdings instead of thinking about how the potential risk of Every single extra stock balances against the potential risk of the existing shares will not be a very good investment approach.

Get access to our ETF know-how Your approach to ETF investing is determined by what type of investor that you are. At Schwab, we offer the help you have to build a portfolio that matches your investment strategy.

The Health Care Pick Sector Index (IXV) is furnished by S&P Dow Jones Indices LLC and includes domestic corporations from the healthcare sector, which incorporates the subsequent industries: pharmaceuticals; wellness care tools and materials; health and fitness treatment vendors and companies; biotechnology; everyday living sciences applications and services; and overall health care engineering. One particular are not able to devote immediately in an index.

The curiosity in ETFs has ongoing unabated considering that then. In the first half of 2020 more than $two hundred billion was invested in ETFs and that’s with stocks inside of a bear sector territory, CFRA Exploration observed.

Critical conclusions are powered by ChatGPT and centered solely from the content material from this article. Results are reviewed by our editorial workforce. The writer and editors just take supreme accountability to the material.

That’s not to state rivals like Charles Schwab and Fidelity Investments aren’t attempting to chip absent at that dominance. Regardless of the large advancement, ETFs continue to be significantly less popular than their mutual fund counterparts, that have about $eighteen trillion in complete belongings.

If you employ accumulation ETFs you may take full advantage of what Albert Einstein calls the eighth wonder of the globe: That is certainly compound curiosity.

Today investors can find an ETF that addresses essentially every asset class no matter if It is really equities or property. ETFs have more than $4 trillion in assets below management and if Bank of The united states’s projection proves correct will swell to $50 trillion in AUM by 2030.

An ETF and mutual fund equally pool cash from traders and spend that capital in a very basket of related securities. They are often actively or passively managed. Unlike mutual funds, ETFs trade like stocks and you'll invest in and promote them on stock exchanges.

Hong Kong Traders – This Site as well as the investment items referenced herein (“Site”) are directed to persons who are “Experienced Traders” inside the meaning of your Hong Kong Securities and Futures Ordinance (Cap. 571) (“Ordinance”). This Web page will not be directed to the general public in Hong Kong. You concur that your use of this Site is topic to you personally reviewing and acknowledging the terms of the disclaimer and the website’s conditions of use. Data herein isn't intended for Qualified Traders in almost any jurisdiction during which distribution or buy is not really approved. This Website won't present investment suggestions or tips, nor is it a suggestion or solicitation of any type to obtain or promote any investment products website and solutions.

REIT ETFs are well-known for his or her potential to supply steady income and diversification Rewards, as real estate typically moves independently of shares and bonds.

The low-Price nature of ETFs is really a leading cause why they’ve resonated with traders in excellent and negative situations.

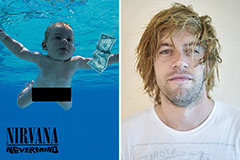

Spencer Elden Then & Now!

Spencer Elden Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Anthony Michael Hall Then & Now!

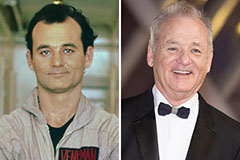

Anthony Michael Hall Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!